Bus depreciation calculator

The bonus depreciation calculator is on the right side of the page. For example if you have.

1

After a year your cars value decreases to 81 of the initial value.

. Bonus depreciation has different meanings to. It is fairly simple to use. The first step to figuring out the depreciation rate is to add up all the digits in the number seven.

Find and calculate the depreciation of your Ford Transit for any stage of your ownership. Depreciable Base Asset Cost -. The depreciable base is given as extra information.

33 MB File size. Take the average bus cost see ii and divide it by the number of years the bus will be in service. After two years your cars value.

Our car depreciation calculator uses the following values source. Percentage Declining Balance Depreciation Calculator. Bus depreciation in August.

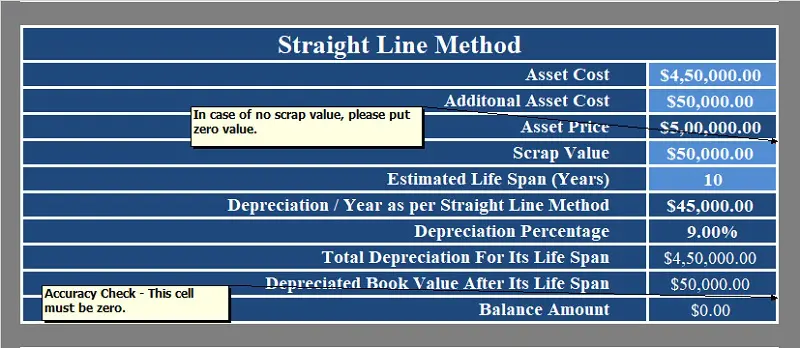

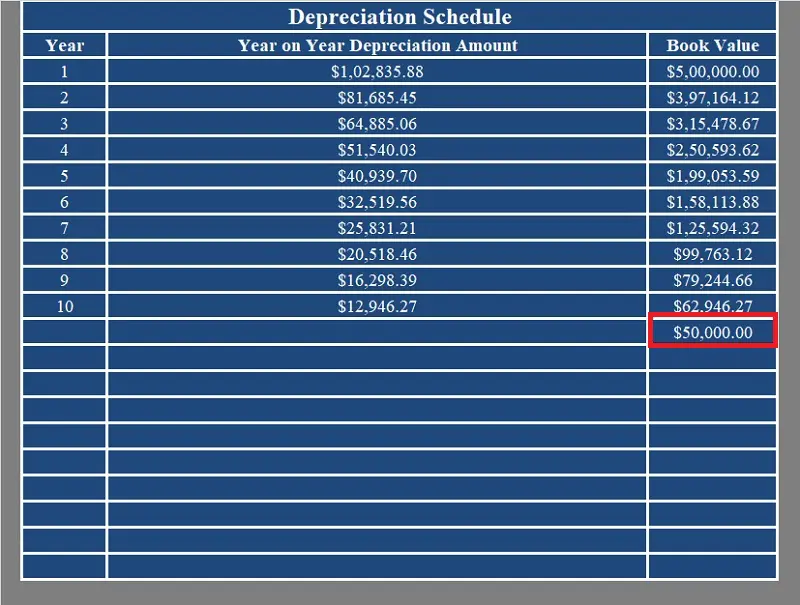

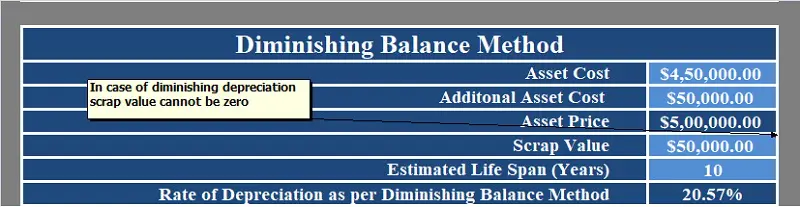

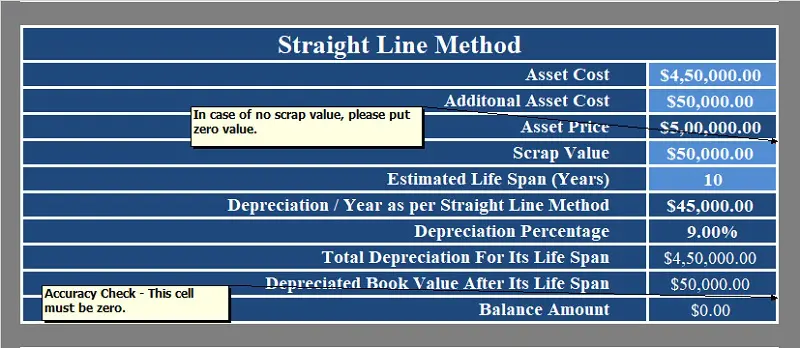

This depreciation calculator is for calculating the depreciation schedule of an asset. We will even custom tailor the results based upon just a few. First one can choose the straight line method of.

The calculator also estimates the first year and the total vehicle depreciation. Ford Transit Depreciation Calculator. Check depreciation for other Ford vehicles.

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Section 179 deduction dollar limits. Periodic straight line depreciation Asset cost - Salvage value Useful life.

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Also includes a specialized real estate property calculator.

To calculate the depreciation cost per year. Next youll divide each years digit by the sum. It is free to use requires only a minute or two and is relatively accurate.

All you need to do is. 7 6 5 4 3 2 1 28. Select the currency from the drop-down list optional Enter the.

The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices. December 2011 System Change. Also paragraph IV 3f.

Depreciation per unit and depreciation for a period. Payment calculated in September. This limit is reduced by the amount by which the cost of.

Depreciation forecasting and bus purchase simulations for school district owned buses can be made using the Excel workbook provided here. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Chapter IV paragraph 3f 2 e states that the useful life of buildings and most other facilities concrete steel and frame construction is 40 years.

The activity method calculation requires 2 equations. The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below. It provides a couple different methods of depreciation.

Download Depreciation Calculator Excel Template Exceldatapro

Annual Depreciation Of A New Car Find The Future Value Youtube

Download Depreciation Calculator Excel Template Exceldatapro

1

Download Depreciation Calculator Excel Template Exceldatapro

1

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

Depreciation Calculator Depreciation Of An Asset Car Property

1

Kly0lddmbdqram

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Car Depreciation Calculator

Our Coach And Minibus Hire Service Is Available Throughout The Nation We Are Delighted To Provide Y Transportation Services Ford Transit Recreational Vehicles

Declining Balance Depreciation Calculator

Beautiful Tire Shop Business Card Check More At Https Limorentalphiladelphia Com Tire Shop B Tax Deductions Free Business Card Templates Music Business Cards